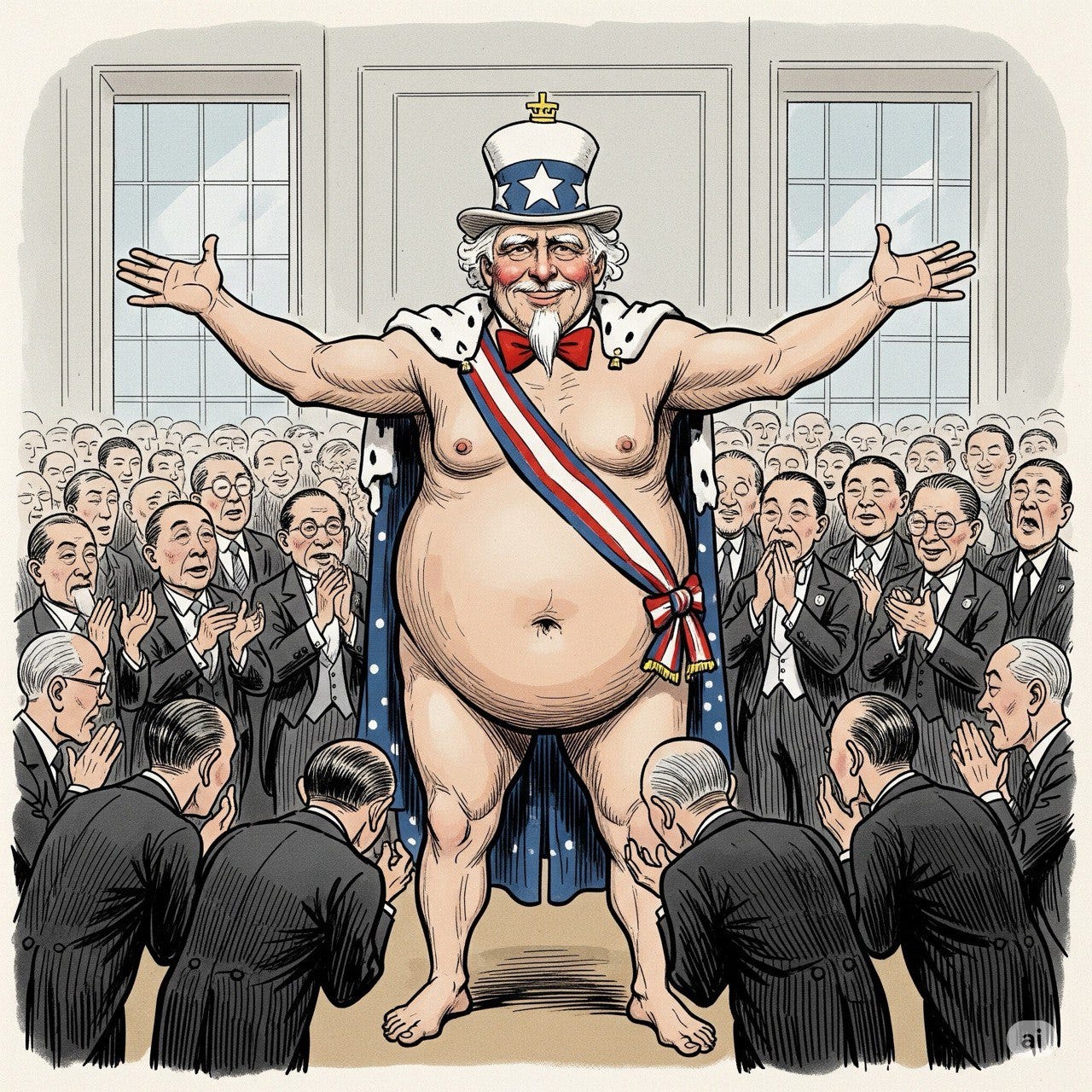

Window dressing

The Japan-U.S. “investment deal”

Donald Trump has announced a deal with Japan whereby - so the claim goes - Japan will “invest” $550B into the U.S. economy and that 90% of profits will subsequently be retained in the U.S. This is presented as some kind of a win for Trump leading some pundits to describe this as a capitulation from Japan.

It’s neither.

Japan has significant U.S. dollar reserves and U.S. treasuries assets, accumulated over years of trade surpluses with the U.S. Japan holds over $1 trillion in Treasuries. In 2024 the Japanese surplus was around $68B.

All this “deal” is, is nothing more than Japan agreeing to cycle its U.S. dollars (mainly those earned via export surpluses into the future) into the U.S. What else was it going to do? As for profits, these would be denominated in USD as well, so of course they would be retained in one way or another in the U.S. at some point. After all, little of the earned dollars would be held in dollars when yield generating alternatives are available.

This so-called “deal” is a PR makeover of normal dollar cycling.

Dollar Recycling in Context

Japan, like many export-heavy economies, runs persistent trade surpluses with the U.S. This means:

It accumulates U.S. dollars;

These dollars are not usable domestically (Japan uses yen); and

So, Japan must invest these dollars somewhere - and U.S. assets, including Treasuries, real estate, equities and corporate projects, are the most natural destination.

This isn’t new or extraordinary at all. It’s systemic to the global dollar-based trade and financial system.

The $550B “Investment”

If Japan is pledging to “invest $550B into the U.S. economy,” that’s more than likely to be just a recommitment to allocating reserves and surplus capital into U.S. projects/assets. This may be dressed up as FDI or infrastructure investment, but it’s still denominated in USD, drawn from existing or expected reserves.

Japan already holds over $1 trillion in U.S. Treasuries, and has for years been a top foreign investor in U.S. government debt, real estate and industrial projects. Nippon Steel just bought out U.S. Steel as a case in point.

Retained Profits in USD

The idea that “90% of profits will be retained in the U.S.” is a meaningless condition in monetary terms.

Profits made in the U.S. from USD investments are, naturally, denominated in USD. Whether reinvested or parked in U.S. financial markets, they don’t leave the dollar ecosystem unless explicitly converted into yen or other currencies, which would hurt Japan’s own exchange rate stability. And if they were sold then the next holder would, in due course, invest those dollars in American assets.

So this bit of Trumpian braggadocio is effectively just a non-statement, spun for optics. Ishiba played along.

Playing along

Calling this a “capitulation” by Japan misses the point. It’s not new policy. It’s not a structural concession. And it’s not even a strategic pivot.

It’s just diplomatic window-dressing that lets Trump frame long-standing capital flows as a political “win.” For Japan, it’s low-cost; they’re doing what they were already going to do, but now get to appear cooperative.

This “deal” is:

Not a win for the U.S.. There’s nothing materially new; and

Not a capitulation by Japan. Japan did what it’s always done with dollar surpluses.

What we have is a PR makeover of standard international financial flows - just dressed up in a populist narrative. So when Japan “invests in the U.S.,” it’s basically just shifting existing or incoming dollars into different forms of U.S. assets - not new capital, just recycled surplus.