Time to look in the mirror

Janet Yellen visits Beijing. While she bloviates about Chinese industrial (over)capacity, the real issues that aren't acknowledged are more to do with US domestic imbalances.

This essay reflects on the key propositions made by US Treasury Secretary Janet Yellen on her recent visit to Beijing. A Chinese version of this essay appears at Guancha.cn.

US Treasury Secretary Janet Yellen came to China with strong messages. She warned China of ‘significant consequences’ should Chinese firms provide support for the Russian war effort in Ukraine, and she castigated China for its industrial over-capacity and its distortionary role on global markets. She argued that China’s over-capacity was a risk to jobs and businesses globally. Her targets were mainly Electric Vehicles (EVs), solar panels (PVs) and lithium batteries.

It’s unlikely that the tough talk will have any material impact on Chinese policy makers or industrial decision-making, though it’s doubtless that the rhetoric was more designed for a domestic audience in an election year than anything else. No Chinese-made EVs are found in the US at present, yet Yellen and others from the Biden Administration are clearly concerned that the possibility of low-cost automotive imports could affect Biden’s re-election prospects in Michigan, the home of the big automakers. Yellen has railed against Chinese EVs as distortionary, creating an uneven playing field and driving unbalanced global development.

What are we to make of Yellen’s comments?

On the issue of supporting third party wars, there is a certain tone-deafness that comes from decades of self-claimed exceptionalism, entitlement and unbridled primacy. That the US is the largest supplier of munitions contributing to the ongoing hostilities in Ukraine wouldn’t be missed by observers less interested in taking ideological pot-shots than in understanding and framing the conditions for possible negotiations. Accusing others of contributing to hostilities while being the largest supplier of armaments does not constitute the ‘moral high ground’. Dropping food aid after providing the bombs and missiles to Israel that have led to over 30,000 deaths in Gaza evinces a moral vacuity and hypocrisy that has radically undermined America’s standing across much of the world.

On the economic questions: the first thing to note is that Yellen’s comments speak of an America that has actually admitted that it can no longer compete. Worse, however, is that attempts to browbeat China about manufacturing and export high quality low cost items, particularly those that address energy decarbonisation, is tantamount to attacking the development ambitions of the Global Majority. Last but not least, Yellen’s attempts to chastise China for its supposed impact on global balance belies a reality that it is in fact US domestic imbalances that are root-cause problems - for both the US and for the world at large.

Over-capacity and weak domestic demand?

I have discussed the issue of China’s manufacturing sector and EVs in particular in previous articles, but it’s worth recalling some key points.

Undoubtedly, China is the world’s industrial powerhouse, with the vast majority of manufacturing output servicing the domestic market. In 1995, China exported 11% of its annual manufactured outputs. This peaked at 18% in 2004 and has tapered back ever since then to current levels of around 13%. As Chinese manufacturing output has grown over the years, so too has the demand domestically. Chinese manufacturing today is less dependent on exports than the Yellen story implies. As for EVs, between 2020 and 2023, output grew and the domestic market consumed between 75% and 85% each year.

The idea of ‘over capacity’ makes no sense for two other reasons. First, as global demand for EVs, PVs and lithium batteries grows, this will need additional capacity. Current capacity won’t be enough. I have estimated elsewhere that to meet projected global demand for EVs by 2035, total global annual production capacity will need to increase by 60.4 million units from 2023 levels. Secondly, it assumes that all countries will have the same industrial capability and won’t need to trade. This is absurd. Global specialisation will mean that some countries will see the development of more industrial capacity in certain product categories, while others will not.

As a sign of this, Chinese EV manufacturers are already actively expanding their manufacturing capabilities in other countries. Chinese EV manufacturers are investing in factories in other parts of the world to service markets. They are already establishing factories in Hungary, Vietnam, Thailand (BYD - image below), Malaysia, Mexico and Brazil. These investments will contribute to greater spatial balance, creating development opportunities for these countries.

Yellen implies that Chinese competitiveness has been achieved by way of government support (industry policy and subsidies) rather than through market-driven means. That Chinese supply chains for intermediate and finished goods are renowned for their intense competitiveness does not figure in what is a caricature of China’s economic model. Yet, cutthroat price competition is a feature of Chinese economic practice. The rapid growth in industrial automation is also a reality, underpinning the growth in productivity we are seeing in EV manufacturing. For example, Xiaomi’s automated production systems are reportedly producing one SU7 model vehicle every 76 seconds.

If there is an argument to be made about intensive and expansive industry policy support, it’s to be found in Europe. In a recent paper, Juhasz, Lane and Rodrik (August 2023) not only find that industry policy has played an important role in economic development across many parts of the world, but that the largest incidence of industry policy intervention between 2010 and 2022, by a long way, has been amongst the richest nations in the world - Western Europe and long-standing OECD members. Without any sense of irony, the European Commission has initiated an investigation into China’s industrial policy support of its EV sector.

Yellen’s argument goes on to claim that China exports to compensate for weak domestic demand. In 2023, according to the national bureau of statistics, China’s per capita disposable income was 39,218 yuan, a nominal increase of 6.3% over the previous year. The real increase was 6.1% after taking into account inflation. In the same period, national per capita consumption expenditure was 26,796 yuan, a nominal increase of 9.2% over the previous year, and 9.0% after accounting for inflation. Household disposable income has increased more than 300% since 2010. The evidence suggests that China’s domestic household incomes and consumption demand is anything but ‘weak’.

She also claims that China has weak demand because its households save too much. Chinese households are well known for their proclivity to save. But, as the demand evidence suggests, they are also strong spenders. While Chinese households save a large proportion of their income, their real disposable income has also exhibited strong growth. In aggregate real terms, Chinese households are spending twice more today than they did 10 years ago. On top of this is the fact that household savings as a proportion of disposable income has also declined from 42% in 2010 to less than 35% in 2019, according to Huang and Lardy in a 2023 paper.

The evidence simply does not support Yellen’s core claims.

Global Development Prospects and Decarbonisation

Addressing climate change is recognised by governments across the world as a collective responsibility. Moves to decarbonise economies is a critical part of the response. The most responsible pathway would be to embrace the least cost approach and harness available capacity to achieve an efficient and timely transition. Yellen’s critique of China’s low cost supply capabilities is, in effect, an argument against this approach to addressing climate change.

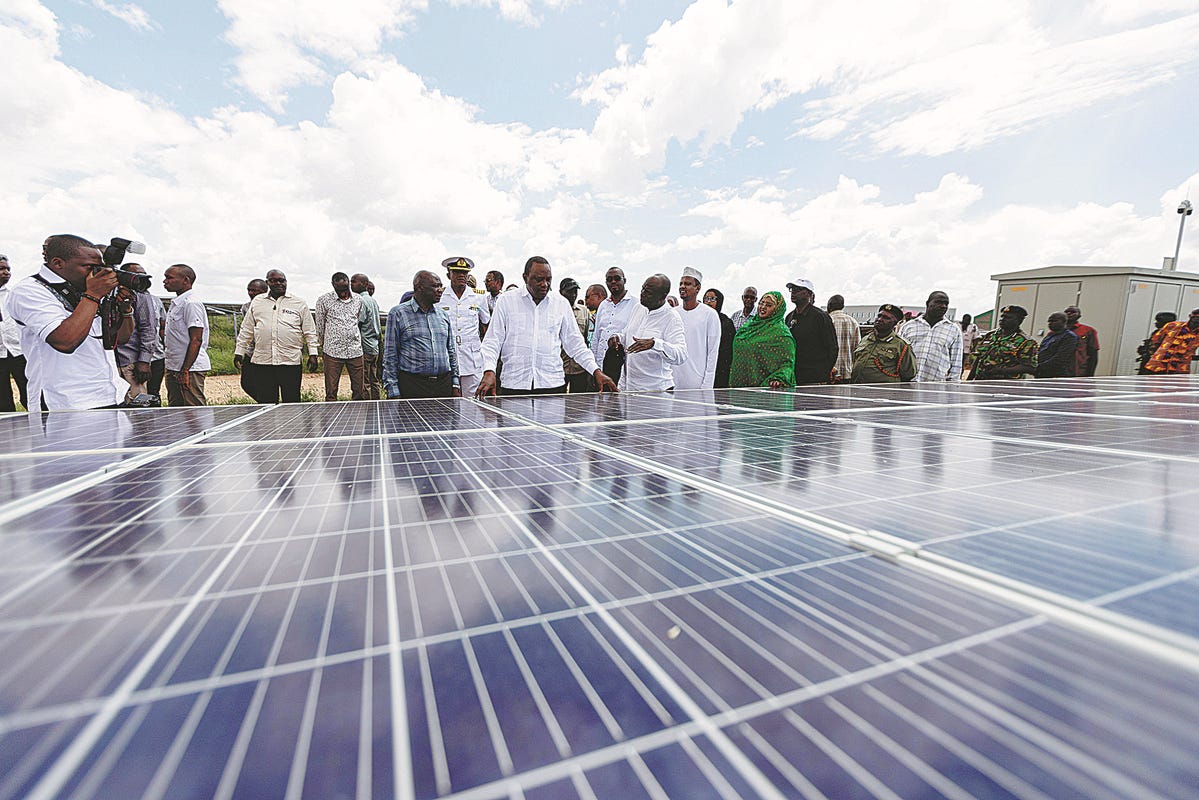

But it also has spillover implications on national development ambitions per se. Take Africa as a case in point. The African continent’s population is rising sharply, as African nations continue to industrialise. These two drivers are underpinning strong growth in energy demand, with total African energy demand projected to grow by over 30% over the next decade, and continue beyond that. According to studies from the European Commission, meeting anticipated demand will require energy generation capacity to increase 10-fold between now and 2065. Doing so requires rapid and large scale deployment of renewable capacities, so as to avoid catastrophic greenhouse gas emissions by 2050.

Africa has the potential to support its population growth and industrial development through the expansion of clean energy capabilities. The demand, even today, is staggering. It is estimated that about 600 million Africans lack access to electricity today. The projected doubling of the continent’s population by 2050 only highlights the scale of the challenges.

In this context, access to large volumes of renewable energy capacity at the least cost possible is critical to meeting the African challenge. Historic commitments to climate change adaptation financing of $100 billion per year from advanced countries to developing nations has failed to materialise. It’s time to enable concrete action to be taken, and China’s output capacity and low costs is a key plank of a global response to the sustainable development of developing countries. Yellen’s complaints about Chinese ‘over capacity’ may play well in Detroit, but they’re likely to fall on deaf ears across the countries of the Global Majority.

That low cost, high quality products that support electrification and decarbonisation are now available on the global market, contributing to the wider implementation of carbon transition initiatives across the globe, appears to be entirely lost on Yellen. American and even European industry may find it hard to compete with China’s supply chain and automated productive efficiency, but tackling climate change is a global challenge best achieved with access to the least cost, most abundant capabilities. Global developmental imbalances need to be addressed in part by the provisioning of low cost energy solutions. China’s industrial capacity meets this requirement.

Coincidentally, the fact that the US is now the world’s single largest producer of crude oil while also castigating China’s efficiencies in electrification naturally raises eyebrows amongst those who see double-standards from a mile away.

American Domestic Imbalances

It is remarkable that the US still thinks it can force others to make adjustments so that America doesn’t have to deal with the consequences and problems of its own making. Yellen speaks of distortions and imbalances, without once recognising that the US is the root-source of many of her own concerns.

The United States economic model has over the past four decades seen a progressive relative decline in industrial capacity. This has been a function of US policy and American enterprise decision-making. The macro-economists that complain about Chinese ‘over-capacity’ argue that it’s due to China’s excessive domestic savings. What they don’t want to discuss is the chronic absence of savings in the US, and the fact that the US has what is apparently an insatiable appetite for the savings of other countries via the selling of US Treasuries.

While China’s household savings to disposable income rate is around 35%, the situation in the US is that in 2023 personal savings amounted to 4.51% of national disposable income. The savings to disposable income measure spiked during COVID at 15.21% in 2020, but never previously surpassed 14% in the last 60 years. Unsurprisingly, household indebtedness is also at record highs, and continues to climb. According to statistics from the Federal Reserve Bank of New York, household debt rose 4.8% from Q3 2022 to Q3 2023. Total household debt, including mortgages, home equity revolving debt, auto loans, credit cards, student loans and other consumer lending such as retail cards was $17.5 trillion at the beginning of 2024. Credit card and auto loan delinquencies continue to rise, signally “increased financial stress, especially among younger and lower-income households.”

Recent survey data indicates that in the US, 60% of adults are ‘living from paycheck to paycheck’. A further 40% indicated that their financial positions at the end of 2023 were worse off than a year previously. Households are so stressed that 20% of respondents of another recent survey said they had gone without food to save money so that they could pay their rent or mortgage.

Yellen talks about ‘distortions’, yet the greatest distortion globally is America’s rising debt, its dollar hegemony, the disproportionate impact of changes in US domestic monetary policies on the welfare of other nations and, last but not least, its penchant for military interventions and war. According to Jeffrey Sachs, over 50% of US Federal Government debt incurred over the past 22 years has gone towards financing the expansion of America’s defence budget.

The problem isn’t Chinese over-capacity; it’s American under-capacity. This is the result of more than four decades of Washington policy priority, which has seen expansion in financial and other services but a relative decline in manufacturing.

The problem isn’t excessive Chinese savings and Chinese under-consumption; it’s excessive American debt and insufficient domestic savings.

The problem isn’t China’s low cost manufacturing causing global distortions; it’s American dollar hegemony, weaponisation of the monetary system and penchant for military interventions.

Yellen came to Beijing and talked tough. No doubt, it plays well to domestic audiences in an election year. But the claims don’t fly. It’s doubtful that rhetoric designed for a domestic constituency will make much headway in China. It’s also doubtful that it will endear the US to countries of the developing world that have long been denied access to affordable technologies that would enable them to successfully develop by rolling out low-cost energy solutions that also meet decarbonisation / low-carbon objectives. Yellen’s arguments in effect would lead to the preservation of global development imbalances, while admitting to the US’ declining competitiveness.

An America not at peace with itself is an America that can’t be at peace with the rest of the world. Domestic imbalances, with households suffering from rising financial stress, underpin a febrile national political environment of growing distrust. It’s time for the US to take a look in the mirror and face up to the need to rebalance its own social settlement through increased household savings, reduced indebtedness, turn away from its global military ambitions and invest instead in the long-haul to new industrial capacity. Yellen is understandably concerned about America’s inadequate industrial capacity. Italian Prime Minister Giorgia Meloni is too, and has reached out to Chinese EV manufacturers to establish a factory in Italy. Instead of pointing fingers at China’s industrial success, Janet Yellen may well be advised to take a leaf out of Meloni’s book.