Chatting with Chat about ... Chat

ChatGPT on OpenAI in the face of DeepSeek-R1 Launch

On 23 January 2025, I had two ‘conversations’ with ChatGPT and DeepSeek AI, sparked by the launch of DeepSeek-R1. The first ‘conversation’ with ChatGPT is provided below verbatim. The core of the questioning related to the impact of DeepSeek on OpenAI’s business model and valuation as well as implications for the ‘Stargate’ initiative - a $500B data centre announcement made by a consortium of US firms.

Here is one major outtake - assuming DeepSeek is 70-90% price competitive vis-a-vis OpenAI, to maintain market share OpenAI would be forced to drop its pricing. As valuation is premised on revenue assumptions, this move could result in a valuation impairment of OpenAI by 80%. As for the Stargate announcement, there are major hurdles that need to be considered.

I hope you find this ‘conversation’ with AI about AI interesting.

My ‘discussion’ with DeepSeek will be posted separately.

WP: A couple of days ago DeepSeek was launched, as an open source alternative to OpenAI and its ChatGPT model. Additionally, the costs of using DeepSeek are considerably lower than is the case for OpenAI and other American-based proprietary AI systems. What impact will this price competition have on OpenAI’s business model and business valuation?

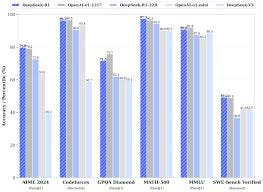

ChatGPT: The recent launch of DeepSeek’s open-source AI model, DeepSeek-R1, introduces significant price competition in the AI industry, potentially impacting OpenAI's business model and valuation. DeepSeek-R1, released under the MIT license, offers performance comparable to OpenAI’s o1 model in tasks such as mathematics, coding, and reasoning, without relying on supervised data. This open-source approach allows developers to use and commercialize the model freely, challenging the proprietary strategies of companies like OpenAI.

Moreover, DeepSeek’s cost-efficient development is noteworthy. Their V3 model, with 671 billion parameters, was trained over approximately two months at a cost of $5.58 million, utilizing significantly fewer computing resources than its competitors. This cost advantage enables DeepSeek to offer AI solutions at lower prices, intensifying competition in the market.

In response to such developments, OpenAI may need to reassess its pricing strategies and consider adopting more open approaches to remain competitive. The emergence of cost-effective alternatives like DeepSeek-R1 could pressure OpenAI to lower its prices or enhance its offerings to maintain market share. Additionally, the availability of high-performing open-source models may influence OpenAI’s valuation, as investors evaluate the company's ability to adapt to a more competitive and democratized AI landscape.

Overall, DeepSeek’s entry into the market underscores the dynamic nature of the AI industry, where innovation and cost efficiency are pivotal in shaping business models and valuations.

WP: I have heard that DeepSeek’s pricing advantage could be as high as between 70-90%. If that's the case, matching this new price point for comparable tasks would severely impact assumptions around revenues for OpenAI and other comparable US initiatives, resulting in a risk of valuation impairment. If this is likely, what are the potential valuation impairments on current valuations?

ChatGPT: If DeepSeek’s pricing advantage truly ranges between 70% and 90%, and OpenAI (or comparable U.S.-based AI companies) must adjust prices downward to compete, the potential valuation impairments could be significant. Here’s an assessment:

Valuation Sensitivity to Price Reductions

Revenue Impact:

Revenue for OpenAI is heavily influenced by user volume and subscription pricing (e.g., for ChatGPT Plus and API usage).

A 70-90% reduction in price would massively undercut expected revenues, even if OpenAI managed to increase user adoption or usage.

For example, if OpenAI originally anticipated $1 billion in annual revenue and had to adjust prices by 80%, maintaining revenues would require an equivalent 5x increase in usage—a highly optimistic scenario.

Market Share Defense Costs:

To defend its market share, OpenAI might need significant investments in innovation, customer incentives, or enhanced infrastructure—escalating operational expenses and eating into margins.

Free Cash Flow Erosion:

Reduced revenues and increased costs lead directly to lower free cash flows (FCF), a critical driver in discounted cash flow (DCF) valuations. A 70-90% decline in the revenue base could result in proportional declines in projected FCF.

Implications for Valuation:

Given that OpenAI and comparable AI startups often trade or are valued at high multiples due to expected growth:

Compression in Multiples: A major revenue and margin reduction would make these companies appear less like high-growth tech firms and more like commoditized service providers, compressing earnings multiples. For example, a company trading at 30x FCF might drop to 15-20x.

Risk Adjustments: Increased competition from open-source alternatives raises market risk, further pressuring valuation.

Example of Valuation Impact:

Assuming a 70% drop in revenue and no compensatory usage growth:

OpenAI Valuation Case (pre-impact):

Initial revenue: $1B.

Expected FCF: $300M.

Market multiple: 30x.

Pre-impact valuation: $9 billion.

Post-Impact:

Revenue reduces by 70%, leaving $300M.

FCF (30% of revenue) becomes $90M.

Assuming lower multiple due to commoditization (e.g., 20x FCF): $1.8 billion valuation.

Valuation Impairment: ~80%.

If the pricing disruption intensifies or investors lose confidence in proprietary AI offerings’ moat against open-source rivals, similar valuation contractions could occur across the sector.

WP: This could be disastrous for the financial models that have underpinned the rapid boom in AI projects particularly in the United States. It also brings into question the recently announced $500 billion investment in AI infrastructure, which could see massive overcapitalisation in an industry whose financial model has been turned upside down by the launch of DeepSeek. I also noticed that ByteDance has also launched an open source AI capability too in the last couple of days.

ChatGPT: The recent developments in the AI industry, particularly the emergence of open-source models like DeepSeek-R1 and ByteDance’s AI initiatives, are poised to significantly disrupt existing financial models and investment strategies. These advancements challenge the proprietary frameworks of U.S.-based companies, potentially leading to over-capitalization in AI infrastructure investments.

Impact on U.S. AI Investments:

The announcement of the $500 billion Stargate AI project, a collaboration between OpenAI, Oracle, and SoftBank, underscores the substantial investments being funneled into AI infrastructure in the United States. This initiative aims to construct data centers and create over 100,000 jobs, marking it as one of the largest AI infrastructure projects in history.

However, the rapid introduction of cost-effective, open-source AI models like DeepSeek-R1 and ByteDance’s AI code editor, Trae, could undermine the financial assumptions underpinning such massive investments. These open-source alternatives offer comparable performance at significantly reduced costs, potentially diminishing the competitive advantage of proprietary AI systems. This shift raises concerns about the risk of over-capitalization in the AI sector, as substantial investments may not yield the anticipated returns if open-source models become the industry standard.

ByteDance’s Open-Source AI Initiatives:

ByteDance has recently launched several open-source AI tools, including an AI-powered code editor named Trae, designed to compete with established platforms like Microsoft’s Visual Studio Code. Additionally, ByteDance introduced Doubao-1.5-pro, an updated AI model aimed at rivaling OpenAI's reasoning models.

These developments from ByteDance further intensify the competitive landscape, challenging the dominance of U.S.-based AI companies and potentially impacting their market valuations. The proliferation of high-quality, open-source AI tools could lead to a reassessment of the value propositions offered by proprietary systems, thereby affecting the financial models of companies heavily invested in AI infrastructure.

Conclusion:

The advent of open-source AI models presents a paradigm shift in the AI industry, compelling U.S.-based companies and investors to reevaluate their strategies. The potential for overcapitalization in light of these developments necessitates a cautious and adaptive approach to future investments in AI infrastructure.

WP: The $500 billion commitment between OpenAI, Softbank and Oracle presumably will be financed principally by debt raising. Is that the case? Is the US Government expected to contribute any finances to this? If so, how much and on what terms? Is it equity or debt?

ChatGPT: The $500 billion investment in the Stargate AI project, announced by President Donald Trump and involving OpenAI, SoftBank, and Oracle, is a significant private-sector initiative aimed at bolstering AI infrastructure in the United States.

Financing Structure:

Specific details regarding the financing structure of the Stargate project have not been fully disclosed. However, it has been indicated that SoftBank will assume the “financial responsibility” for the venture, while OpenAI will handle operational aspects. Given SoftBank's role, it is plausible that the funding could involve a combination of equity investments and debt financing, aligning with SoftBank’s typical investment strategies.

U.S. Government Involvement:

The U.S. government's role in the Stargate project appears to be primarily supportive rather than financial. President Trump has expressed intentions to use executive actions to expedite the project's development, particularly concerning energy infrastructure, to facilitate the construction of data centers and related facilities. There is no current information indicating that the U.S. government will provide direct financial contributions, whether in the form of equity or debt, to the Stargate project.

In summary, while the Stargate AI initiative represents a substantial private-sector commitment to advancing AI infrastructure in the U.S., the precise financing mechanisms remain to be clarified. The U.S. government’s involvement is focused on regulatory support to ensure the project's successful implementation.

WP: What is the anticipated ROI for an AI data center investment? How is the change in the competitive landscape, particularly on pricing and revenues discussed earlier thanks to DeepSeek, going to impact the risk parameters of such a large commitment to AI data center hardware? Also, what kind of energy demand is a $500 billion AI data center going to create? Does the US grid have sufficient capacity to handle this demand? If not, how is the additional demand to be met? Or will it simply drive up electricity costs and those unable to pay the higher prices will simply not have electricity from the grid?

ChatGPT: The potential impacts of a $500 billion AI data center investment on ROI, energy demands, and the broader competitive landscape are far-reaching. Here’s a detailed analysis:

Anticipated ROI for AI Data Centers

AI data center investments typically hinge on a high utilization of computing power for AI training and inference tasks, and the ROI is contingent on several factors:

Revenue Drivers:

Service fees (e.g., AI API usage, cloud subscriptions).

Integration into value-added platforms (e.g., enhanced search, coding assistance, custom ML models).

Costs:

Operational expenses, including energy, maintenance, and staff.

Hardware and technology obsolescence risks.

ROI Range:

Historically, cloud-based data centers see an ROI in the range of 10-15% annually under stable market conditions.

For specialized AI infrastructure, higher returns of 20-30% have been projected based on AI's scalability. However, such margins are now at risk due to the rise of cost-efficient, open-source alternatives like DeepSeek.

Impact of Competitive Landscape Changes

Key Risks Introduced by Open-Source Disruption:

Revenue Compression: DeepSeek and others undercut proprietary pricing models, reducing AI service revenues.

Higher Uncertainty: Investor confidence might waver due to lower profit margins and compressed growth expectations.

Stranded Assets Risk: If revenue growth fails to materialize, significant parts of the $500 billion in infrastructure could underperform relative to demand forecasts.

Risk Parameters Adjustment

Discount Rates Increase: Increased competition necessitates adjusting for higher risks in discounted cash flow (DCF) analyses, lowering present valuations for future returns.

Longer Payback Periods: The time required for the centers to become cash-flow-positive may increase as revenue assumptions fall.

Intensified Capital Scrutiny: Lending institutions may impose more stringent debt terms or hesitate to participate due to uncertain ROI.

Energy Demand of a $500 Billion AI Investment

Large-scale AI data centers are energy-intensive, mainly due to cooling and hardware requirements.

Projected Energy Consumption:

AI infrastructure may require 50-100 terawatt-hours (TWh) annually based on current AI computing requirements, with newer systems like GPUs and TPUs consuming tens of megawatts per facility.

A project of this scale could account for as much as 2-3% of the entire U.S. annual energy consumption.

Capacity of U.S. Grid:

Challenges: The U.S. grid is already under strain during peak times in some regions, and a $500 billion project could push several states over their energy supply limits.

Renewable Integration: Massive integration of renewable sources like solar and wind would be required to meet additional demand sustainably.

Policy Support: Government incentives may need to be increased to encourage clean energy growth.

Meeting Demand Without Raising Costs

Infrastructure Upgrades:

High-voltage transmission lines would need expansion to transport renewable energy.

Localized microgrids and energy storage (e.g., lithium-ion or other battery systems) are essential.

Risks of Rising Costs:

If grid upgrades and renewable supply don’t keep pace, electricity costs could rise.

Marginal consumers, such as residential households and small businesses, may face challenges in affording energy, creating inequity.

Potential Energy Solutions:

Co-location with renewable energy sources (solar/wind farms).

Implementing energy-efficient cooling and design in data centers.

Government-imposed regulatory pricing for fair access to electricity.

Concluding Thoughts

The combination of market competition, open-source disruption, and significant energy needs creates substantial challenges for the Stargate AI initiative. Unless mitigated with innovative policies, flexible financing models, and advanced infrastructure planning, this investment risks ROI dilution and socio-economic repercussions from increased energy costs.