BRICS and the Architecture of a Post Western Global Order

A Strategic Response to Western Systemic Disintegration

“Any Country aligning themselves with the Anti-American policies of BRICS, will be charged an ADDITIONAL 10% Tariff. There will be no exceptions to this policy. Thank you for your attention to this matter!”, bellowed U.S. President Donal Trump on 7 July 2025. This social media outburst was prompted by the issuance of a joint statement by BRICS leaders, who convened in Rio de Janeiro in Brazil.

On the same day, Trump began signing and sending off his fabled tariff letters, announcing to recipient heads of state the unilateral determination of Trump’s administration on the applicable tariff to be charged for products from those countries. The letters opined about the absence of reciprocity, rationalising whatever tariff rate Trump announced.

These two missives seem intertwined, reflective of failed bilateral ‘negotiations’ post the suspension of the so-called ‘Liberation Day’ tariffs on the one hand, and a belief that BRICS is an American adversary on the other. The failure of the negotiations over the past near-90 days speaks of collapse of American coercive leverage and the passing of an indifference threshold amongst many nations. Trump’s suspension two days after the grand proclamation of the misnamed reciprocal tariffs regime on most countries and the subsequent escalation of tariffs with China, which refused to cede to his unilateral whims, evoked a strategic blunder of considerable proportions.

He’d boxed himself into a corner. No matter how many puckered lips he would claim were lining up the “kiss my ass”, the Trump administration had effectively alienated nations across the board while creating strong incentives for them to coordinate their approaches.

And now, we come to the convening of BRICS. This event, in Brazil, marks more than just another gathering of non-Western states. It is a declaration - quiet but unmistakable - that a new global architecture continues to take shape. Despite years of Western scepticism, caricature and efforts at containment, BRICS has expanded its institutional footprint, global relevance and strategic coherence.

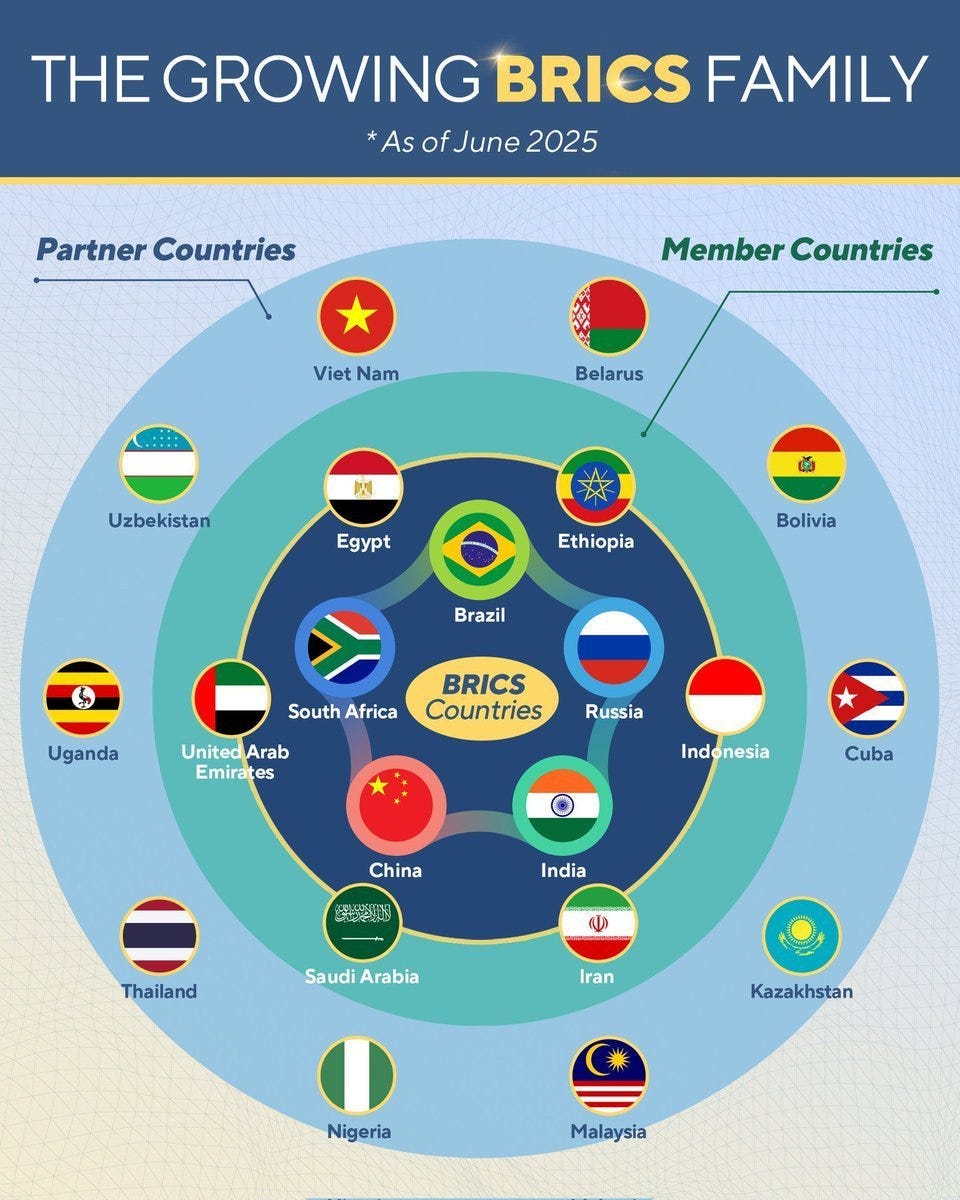

With ten full members, an expanding circle of partner countries, and over 50 countries seeking affiliation, BRICS is no longer merely a diplomatic forum. It is becoming a gravitational force within the emerging multipolar world, and a structural response to the intensifying contradictions of Western-led globalisation.

Together, the BRICS network accounts for 50% or thereabouts of global GDP on a purchasing power parity basis. It represents more than half the world’s population. BRICS nations are delivering stronger growth than the collective west. More critically, it commands a vast share of the world’s energy reserves, industrial production and critical minerals, thereby placing it at the centre of the real economy upon which global stability depends.

This influence is not just economic. It is systemic. In a world where the material foundations of prosperity - energy, infrastructure and food systems - are under threat, BRICS offers a model of international cooperation rooted in mutual development, strategic autonomy and infrastructural interdependence; sovereign and interdependent.

The Real Economy and Systemic Exchange Value

Unlike the financialised West, BRICS economies remain grounded in the logic of what I have termed Systemic Exchange Value; that is, the capacity to generate and circulate real use values necessary for social reproduction and economic sustainability. Energy, in this framework, is not simply a commodity to be speculated on. It is the substrate of productive life: the energetic base upon which value is created, stored and exchanged.

In this regard, the BRICS grouping enjoys decisive structural advantages. Russia, Iran, Brazil, the UAE and Saudi Arabia are major energy producers. China leads in renewable energy capacity, grid innovation, and energy storage. These endowments allow BRICS members to anchor value in material reproduction, rather than via financial abstraction.

This contrasts sharply with the West - particularly the United States - where value extraction has become divorced from real production. What began in the 1970s as the liberalisation of capital markets has matured into a hypertrophic regime of financialisation, whereby profitability is driven less by technological innovation or productivity growth, and more by asset inflation, debt-leveraged speculation and shareholder enrichment.

The U.S. Financial Model: Global Distortion and Domestic Hollowing

The transformation of the U.S. economy over the last four decades has been profound, and profoundly destabilising. Money capital has flooded into financial assets rather than physical infrastructure. Corporations increasingly prioritise share buybacks over investment in fixed capital formation. Banks have shifted from lending to productive enterprises to acting as speculative platforms. The result is a bifurcated economy: financial wealth accumulation at the top and stagnation and precarity below.

Domestically, this has produced widening inequality, shrinking industrial employment and a decaying infrastructure base. Real wages have stagnated for the majority, household debt has soared, and a generation of Americans face declining life expectancy and unaffordable healthcare, housing and education. Politically, this has fueled polarisation, disenchantment and a retreat into nostalgia and culture war posturing.

Globally, the consequences are just as corrosive. The dollar’s status as the world’s reserve currency has allowed the U.S. to externalise its imbalances by running persistent trade deficits while exporting volatility. Nations are forced to hold dollar reserves to access global markets, tying their monetary policies to the U.S. Federal Reserve and exposing them to cycles of capital flight, interest rate shocks and dollar liquidity shortages.

The United States has come to depend on financial inflows to fund consumption, while the real economy withers. In parallel, it has deployed financial infrastructure - SWIFT, sanctions, and dollar clearing - as a geopolitical weapon. The more these tools are used for coercion, the greater the incentive for the rest of the world to build around them. What was once a privilege is now a liability.

This logic of systemic dysfunction is not limited to the United States.

Europe’s Economic Unravelling: Energy, Competitiveness, and Strategic Confusion

Western Europe faces a different but no less severe crisis. Its postwar model, anchored in German industrial exports, French agricultural stability and cheap energy imports (primarily from Russia), has been dismantled by geopolitical rupture and self-inflicted policy incoherence.

The decision to sever from Russian energy supplies has plunged Europe into a state of structural energy insecurity. Natural gas prices have surged. Electricity costs are among the highest in the world. Manufacturing is being offshored or shuttered altogether. German industry, the continent’s manufacturing backbone, now faces an existential crisis. Steel, chemicals, and automotive sectors - once global leaders - are struggling to stay viable.

At the same time, Europe’s green transition has stalled. Over-reliance on intermittent renewables, premature decommissioning of nuclear and fossil infrastructure, and failure to invest in storage or grid resilience have created a perfect storm of vulnerability. What began as an energy transition has become an energy trap.

Europe’s response, comprising subsidies, tariffs and strategic autonomy slogans, amounts to reactive protectionism. Meanwhile, Europe’s geopolitical positioning grows more incoherent. It champions multilateralism while participating in sanctions that fragment trade. It lectures on rules while seizing sovereign assets. It preaches peace while escalating military deployments.

This crisis is not merely cyclical; rather, it is structural. Europe no longer possesses a coherent industrial or energy strategy. It has outsourced security to the U.S., supply chains to Asia, and now finds itself in a strategic cul-de-sac, dependent on expensive American LNG, locked into U.S.-led confrontation with China and unable to generate endogenous growth. Its planned turn to ramping up military spending may inject new liquidity into the flaccid economic system, but it will also channel this wealth into a narrow range of activities with limited system-wide benefit. The rentiers of the military industrial complex will, doubtless, rub their hands together in anticipation but ordinary working households will find little joy in this militarised turn.

Autoimmune Geopolitics: Projecting Decline, Attacking Alternatives

In this context, the attacks on BRICS members - economic, rhetorical and sometimes military - must be read for what they are: autoimmune reactions. Unable to resolve their own internal contradictions, Western powers have projected blame outward, targeting those who dare to pursue alternative development paths.

Russia is sanctioned not merely for military actions, but for asserting resource sovereignty. Iran is isolated and attacked not for its nuclear ambitions, but for refusing to bow to Western economic dictates. China is confronted not because it poses an ideological threat, but because it models a functioning alternative: one based on infrastructure, planning and state-led development. Even erstwhile neutral states seeking to hedge - India, Brazil and South Africa - are treated with suspicion and pressure.

What these reactions reflect is a deeper insecurity. The Western order - rooted in postwar liberalism and post-Cold War unipolarity - is no longer able to secure domestic cohesion or global legitimacy. Its crises, of inflation, inequality, ecological volatility and institutional breakdown, are internal. Yet its response is externalisation: punish others, fragment the world and escalate tensions.

Ironically, these efforts only accelerate the very transformations they seek to delay. Sanctions create incentives for monetary innovation. Exclusion drives new institutional forms. Hostility produces solidarity. The attempt to smother BRICS has, in effect, given it purpose.

BRICS: Strategic Infrastructure for a New Developmental World

In this landscape, BRICS offers the Global South two essential strategies.

First, it provides a platform for reform. Many BRICS members continue to call for the transformation - not the abandonment - of existing multilateral institutions. This includes fairer voting rights in the IMF and World Bank, a restructured UN Security Council and global trade rules that support industrial development, not just liberalisation. This focus on reforming existing institutions was again prominent in the joint statement of BRICS nations.

Second, it offers protection. Should reform prove impossible, BRICS is building the systems to reduce dependence: trade in national currencies, sovereign digital platforms, development banks without conditionality, and cooperative approaches to energy, food and technology. The goal is resilience not autarky, but autonomy with interdependence. Again, this hedging could be seen in the progressive development and consolidation of its own institutions that run in parallel to, and not against, those dominant institutions of the post-war era.

This shift is already visible. The BRICS New Development Bank funds projects in local currencies. Russia and China conduct energy trade outside of the dollar. Saudi Arabia and the UAE are engaging in multipolar financial and energy diplomacy. Even African and Latin American states are exploring BRICS+ engagements to break free from debt cycles and dependency. The introduction of Indonesia and other countries of southeast Asia into the grouping simply consolidates the diversity of economic resources that can contribute to more effective and balanced trading amongst member states.

China: The Unflappable Heart of a Multipolar Order

At the heart of BRICS lies China - unflappable, disciplined and forward-looking. Its rise is not merely a function of scale, but of strategic continuity. In contrast to the volatility of Western politics, China offers stability. It invests in long-term infrastructure, pursues ecological modernisation, and promotes interconnectivity through logistics, finance and data platforms.

China does not demand ideological conformity within BRICS or indeed elsewhere across the Belt and Road Initiative ecosystem. Instead, it enables alignment on shared goals: development, energy security, technological upgrading and multipolar cooperation. It embodies not a hegemonic power, but a gravitational one - capable of holding diverse partners together while avoiding collapse into rivalry.

The BRICS Horizon and the Reckoning of Globalisation

The age of Western-dominated globalisation is over. What remains is a transition marked by some uncertainty and flux; one defined by systemic instability, geopolitical realignment and the search for new institutional forms.

BRICS is not an anti-Western project. It is a post-Western one. It represents a collective effort to recover sovereignty, build real economies, and reconfigure global governance in line with contemporary realities. It offers the developing world tools of cooperation and mutual empowerment rather than dependency and conditionality.

For the West, BRICS is both a challenge and an opportunity. It can be met with hostility and hubris (the current default reaction) or with introspection and reform. But the choice is narrowing. The world will not wait for the West to heal itself. BRICS is not the future because it seeks to displace the West. It is the future because it is already doing what the West no longer can: building systems that work, for the majority of humanity, in the real world of energy, infrastructure and interdependence.