System transformations abetted and hastened by self-corrosive autoimmune reactions are symptomatic of a political class caught up in a hubristic simulacra. One area in which autoimmunity is playing out is in the field of digital and communications technology. The efforts to hobble Chinese communications and information technology company Huawei exemplifies autoimmunity and its effects.

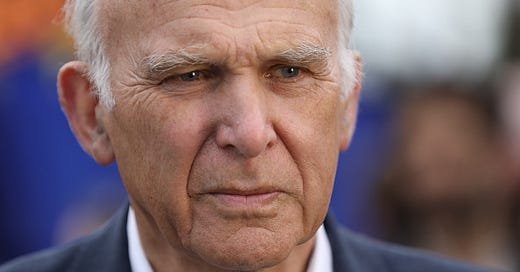

A case in point is the UK Government decision in July 2020 to ban Huawei, announcing that Huawei products would be stripped entirely from the UK’s 5G network by the end of 2027. The rip-and-replace decision was ostensibly based on security advice from the National Cyber Security Centre. However, this rationale has been undermined by former government industry minister Vince Cable (pictured) who claimed that the ban was undertaken “because the Americans told us we should do it.”

The rip-and-replace requirement has been costly. British Telecom has estimated that it has cost them US$612m already, and Vodafone has indicated that the removal of Huawei technology from its network has placed an “additional burden to an already constrained capital prioritisation process.” Chief network officer Andrea Donà went on to say that, “We don’t get any additional money when these things happen. …The net effect of the Huawei high-risk vendor swap legislation means we’ve had to scale back 5G.”

A recent MedUX report (2023) indicates that London is now lagging behind European peers in terms of the quality of 5G network services. The MedUX benchmarking shows that the overall best 5G mobile experience across Europe is found in Germany, France, Portugal and Italy on key measures of speed, coverage and reliability. According to Rafael Galarreta, chief marketing officer of MedUX, one of the reasons for London’s poor overall relative performance is lagging infrastructure resulting from the Huawei ban imposed in 2020. The opportunity-cost risks were well known beforehand.

Prohibitions and bans against Huawei always ran the risk of backfiring. The implications are threefold:

Uncompetitive service standards impacting economic and social service provisioning and innovation;

A revivified Chinese semiconductor sector set to drive down global costs and prices, with flow-on effects on incumbent firms in the west; and

Systemic transformation with Huawei (amongst others) providing the critical mass to develop and drive forward open source, undermining the IP-rent based model that has anchored western / US bigtech.

Reduced Performance Levels

As the London case suggests, the first order impact has been on digital service quality as well as the non-recoverable capital costs of rip-and-replace. Meanwhile, Huawei has emerged as the global leader in industrial 5G. It has developed within a broad ecosystem context, through alignment with GSMA’s Open Gateway Initiative. The Initiative is a framework of common APIs enabling universal accessibility to operator network capabilities. Developers and cloud service providers can rapidly design and roll-out improved and new applications. Already, China has more than 10,000 industrial or enterprise 5G application projects, off the back of an infrastructure that accounts for about 60% of the world’s total 5G base station install base. Huawei is central to this outcome.

The opportunity cost of delays in 5G capability are not insignificant. Huawei is already moving to so-called 5.5G. At MWC 2024 in Barcelona in February 2024, Huawei released its 5.5G intelligent core network solution, incorporating heightened levels of computational and transmission capacity.

Global Market Impacts - Lower Costs

The second order impact goes to the foundations of systemic transformation. Not only did Huawei as a single enterprise find ways to prosper in the face of the full-court press, its survival was also catalytic for an ecosystem transformation in China. For high performance semiconductors, Chinese enterprises historically relied on supplies from overseas manufacturers. Since the US extended and intensified the prohibitions on sales of high-end chips to Chinese enterprises, the Chinese government and industry have responded with significant investments to develop indigenous capability. This is already delivering results. Huawei released the Mate60 Pro smartphone during US Commerce Secretary Raimondo’s China visit in September 2023. In April 2024, Huawei released its Pura 70 smartphone, with domestically produced AI chips. Huawei is not only a key user of semiconductors, it is also an anchor in the overall Chinese semiconductor supply chain.

Sanctions on Huawei have, inadvertently, led to its move to support local start-ups such as YMTC and BOE. In 2020, under the cloud of sanctions, Huawei incorporated YMTC’s 64-layer SSD into the Mate 40 supply chain. Similarly, BOE’s high end screen was accepted into the Huawei system when other OEMs only wanted Samsung and LG screens. Other suppliers, such as oFilm and Lens Tech survived their early days in part - perhaps, in large part - because they entered the Huawei supply chain. The Pura 70 is built with almost all domestic components.

China’s semiconductor supply chain has kicked into another gear. It has expanded production of so-called ‘legacy chips’, growing global market share to 39%. Indeed, there are now concerns amongst the western political and policy advisory elite that China’s semiconductor sector could ‘flood the market’ with low cost ‘legacy chips’, seriously impacting the commercial health of western semiconductor firms. The ability to significantly shift the cost economics of the semiconductor market globally is another installment of the west’s great fear: Chinese capacity and its impact on pricing. The impact on pricing is systemic because it signals a shift away from a sector that has largely been dominated by ‘rent seeking’ business models, to one where intense competition drives down costs and prices.

The End of IP-Rent Seeking

The third order impact is also systemic in nature, and goes to the role that Huawei plays in the development and rollout of open source code. Its open source focuses on core software such as Cloud Computing, Operating Systems - such as its HarmonyOS, Database and AI. It is one of the world’s largest contributors to open source projects, with 105 repositories currently available. Open source runs counter to the traditional IP-rent driven model that has underpinned the commercial dominance of western (US) bigtech.

Attempts to hobble Huawei have backfired. Service standards without Huawei involved have declined, as the case of London 5G demonstrates. China’s domestic semiconductor capability has been enhanced, in no small part due to the role of Huawei in the development and use of locally developed and produced hardware. Huawei’s operating model is also transforming global IT, as its ongoing contribution to the development of open source solutions undermines the IP-rent model of US bigtech. Lower technology costs and lower development costs are the result of these systemic transformations.

In the name of defending something, the risk is that the actions taken ultimately destroy that which one seeks to protect. This is autoimmunity at work. It’s happening across the entire geopolitical economy terrain, and no more is it evident than in the space of modern technology. Chinese firms may still lag in certain technologies (just as they lead in others), but the issue at stake isn’t one or another technology, it’s the features and nature of the system itself. A full-court press against Chinese firms on certain technologies - the so-called ‘small yard / high fence’ - is hastening systemic transformations that adversely impact the financial models of incumbent technology firms in the west and at the same time catalyse system transformations through the consolidation of critical mass behind open source technologies.